Real Estate Reno Nv Fundamentals Explained

Real Estate Reno Nv Fundamentals Explained

Blog Article

The Greatest Guide To Real Estate Reno Nv

Table of ContentsEverything about Real Estate Reno NvFacts About Real Estate Reno Nv RevealedExamine This Report on Real Estate Reno Nv5 Easy Facts About Real Estate Reno Nv ExplainedNot known Details About Real Estate Reno Nv Rumored Buzz on Real Estate Reno Nv

With the right upkeep and administration, you may produce a consistent rental income also if a property's value remains level for a while. All capitalists should therefore do their research prior to devoting to a purchase in a particular location. A REIT can be profitable in two different methods: First, REITs consistently pay dividends to financiers.Take advantage of, or the capacity to take down a little quantity of one's own cash and borrow the remainder to acquire a residential or commercial property, is a key advantage of genuine estate investing. Purchasing top notch realty for just 15% of the whole expense, taking down a deposit from savings, and obtaining a home loan to pay the continuing to be amount.

It additionally makes sure that a person will only spend a portion of their revenues in genuine estate. Real Estate Reno NV. As a result of the boosted usage of modern technology and the requirement for more convenience and comfort in day-to-day live, there has been a stable surge in the demand for smart homes in India over the past few years

Not known Details About Real Estate Reno Nv

To decrease the adverse impacts of housing growths on the environment, developers are additionally advised to focus on utilizing green products in construction. It's vital to keep in mind that India is only just beginning to embrace wise homes, and the sector is still creating. Because of this, clever houses can just be offered in a few places or jobs, and their installment and upkeep prices may be higher than those of traditional homes.

In India, acquiring realty is a protected type of financial investment. Compared to other assets like the stock market, gold, cryptocurrencies, and even banks, buying actual estate can be much safer. The securities market is always changing, for this reason making it fairly risky. Compared to various other company financial investment alternatives like shares and mutual funds, property investing in India has a reduced volatility quotient.

Commercial property is frequently recognised as a much better financial investment alternative. Relying on your place, managing a service home might at some point pay off if you can manage it. Residential genuine estate comes close to commercial actual estate. The average residential or commercial property rate went from Rs. 5,826 per square foot in 2021 to Rs.

The Ultimate Guide To Real Estate Reno Nv

The practice of acquiring realty as a financial investment as opposed to a long-term residence to earn money is called genuine estate investing. It may be merely defined as any kind additional resources of tract, building, framework, or various other substantial possessions that can be transferred for an earnings even if it is frequently unmovable.

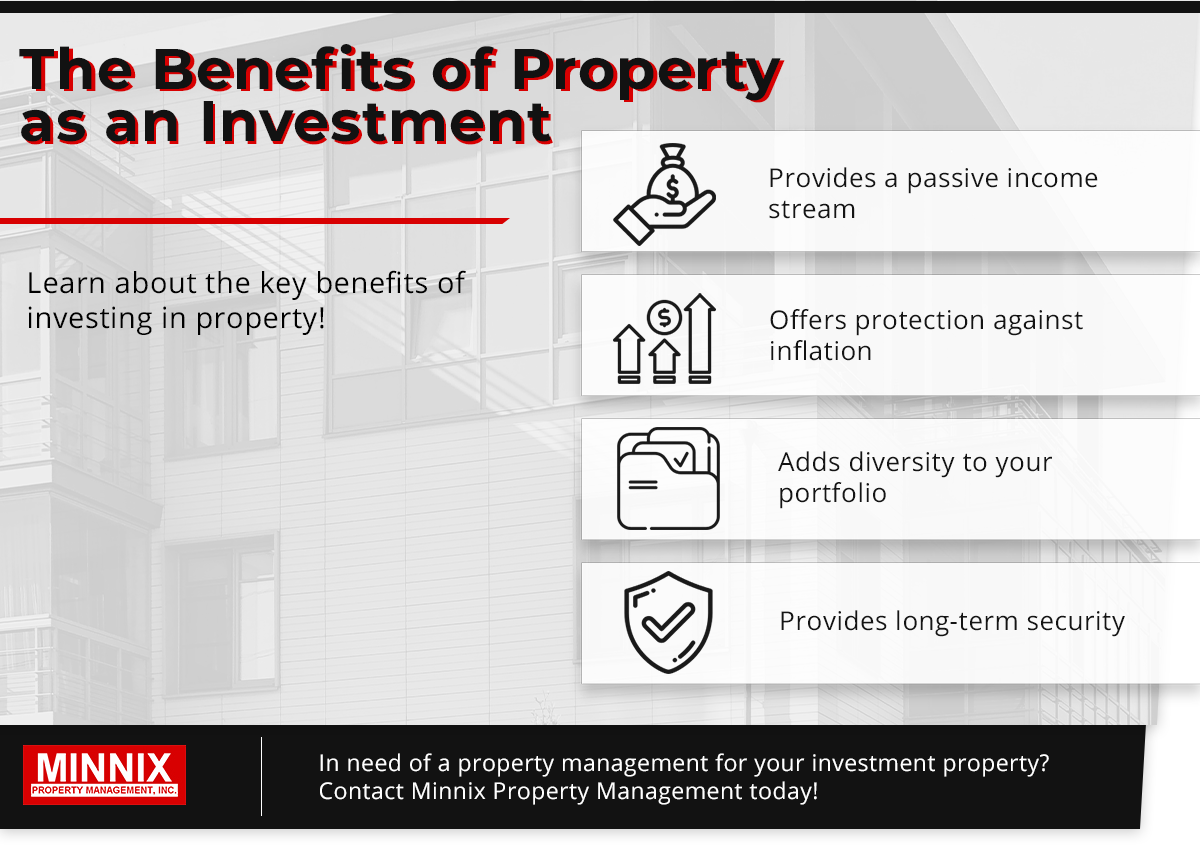

For some, investing in realty can equate to hundreds of dollars in additional income every year. And experts say that in today's inflationary environment, doing so could show to be a critical action. "A property investment provides a hedge against inflation if rental fees maintain rate with, or outpace, the rate of inflation," claims Derek Graham, principal and creator of Odyssey Feature Team.

About Real Estate Reno Nv

"The degree of income produced depends on both the location and type of property asset." Graham notes that realty investments usually have a reduced relationship to the stock market, so you can utilize them to hedge against losses during market slumps. Having a varied mix of assets in your profile likewise spreads your danger out across asset kinds, meaning you'll have a higher possibility of coming out on top when some of your other possessions aren't doing.

Extra income, Portfolio diversification, Tax obligation breaks Possibly much more hands-on, Straight home investments are illiquid There are several means to buy realty, either directly or indirectly. Depending upon the route you take, not all kinds of genuine estate financial investments will call for a lots of time or capital.

"In many cases, capitalists might need as low as a couple of thousand dollars to start." A couple of typical means to get in on the property video game, include: This is when you get all or a stake in a specific home about his such as a house, home, real estate complex, shopping mall, or commercial office structure.

The Buzz on Real Estate Reno Nv

Spending in real estate stays one of the best ways to accumulate wealth, both in terms of appreciation in market worth as well as generating a reputable regular monthly money flow. Historically, real estate has actually been much less unstable than the stock market, especially through harder economic times.

Maritz shares the main advantages of actual estate financial investment:: Unlike many other investments, property has the capacity to create capital, either in the kind of earnings as soon as you have actually repaid your home mortgage or as rental revenue, whether from an income-producing flatlet on your key house or from different residential or commercial properties.

What Does Real Estate Reno Nv Do?

: Generally, the value of properties appreciates with time which implies that the longer you've had a building, the more it will be worth, making it the perfect nest egg.: As a property operator, you're able to deduct products such as passion and upkeep in time as company write-offs.

Report this page